Oct 15, · Good Day Trading % Profitable Best Moving Average Crossover For Intraday Forex Trading Strategy. Find Latest info Relevant to Good Day Trading. Price Action in Foreign Exchange There is also an approach for part-time investors that appear Jan 02, · Triple moving average: This 3 moving average crossover strategy is consider to be one of best strategies and solution for longer term direction. This can be take so much time to make sure that entrance signals and exit plan working greatly to not creating any issue in it Jan 06, · 3 EMA Crossover Trading The three moving average crossover strategy is an approach to trading that uses 3 exponential moving averages of various lengths. All moving averages are lagging indicators however when used correctly, can help frame the market for a blogger.comted Reading Time: 6 mins

How to Earn Profits Using Moving Average Crossover Strategies? | blogger.com

Traders use moving averages MA to gain a concise idea of the price movement. They can be used as the main analytic tool or just to back up a best forex moving average crossover strategy decision. But since the MAs are lagging pointers, crossovers are used by traders to strengthen their decision. With MA crossovers, you get a candid trading signal with sufficient inputs on resistance and support range irrespective of how long the trade is held.

We will see the different types and how you can practice them for reaping huge profits. Of the various MAs, two types are more prevalently in use than the rest. These include long and short-term moving averages. An extended period of 50 or more days makes this type a slow-moving one. A crucial factor to note here is the less reaction to the price action over the short term when associated with the brief-term type. Furthermore, you get fewer signals here, which makes them more significant.

But, the slow movement can make the signals more lagging than the rest. As the name implies, this type has a shorter span, such as 5, 10, etc.

The short span best forex moving average crossover strategy it an active indicator of the price action. The frequency of signals is more, which makes them more significant, but there is the hazard of more false signals, best forex moving average crossover strategy.

Of the two types above, the shorter and reactive average is vital as it can give a precise market movement. Both of them are utilized best in a market that is trending and where the possibility of sideways trade is present. With a shorter time, best forex moving average crossover strategy, the information provided by the moving average is very sensitive. The advantages include closer tracking of the price action and a superior number of trades.

The drawback of this signal is there are more false indicators. And, since it is more sensitive, the strategy does not work effectively in sideways trade. But, the timelier signal makes up for the lack of effectiveness.

To succeed with this strategy, you need to identify the consolidation and trending segment. For confirming whether you are inside or exiting a consolidation part, the price movement is the identifying factor. You can spot the troughs and peaks here instead of the lows that you notice in a downward movement.

Linking the price action with short timeframe crossover signals results in better accuracy and a lower possibility of false signals. When compared to the short-span crossovers, the longer span ones are more crucial, which is why the following two methods are considered necessary by traders. A golden cross is a term that denotes a marked change in the market sentiment where bulls remain dominant. This happens when the moving average of a medium-term such as a day mean crosses a long term one such as a day average.

Death cross denotes a change where the bears are dominant. Here the medium span average crosses below the day MA. When broken, a huge resistance level is reached by the day moving average, best forex moving average crossover strategy, following a drop-down of the medium span average and an upward penetration occurring in the wake of a support level.

So, it is common to see the price movement being restricted between the long term and medium averages shifting constantly flanked by best forex moving average crossover strategy extreme prices here. Swing trade possibilities are more in this situation.

Although there are several different crossover methods used by traders, they are not equal in the results they produce. There are alternate averages that can have a more potent impact, like the EMA Exponential Moving Average. This average provides a better interpretation of recently formed candles when compared to the older ones.

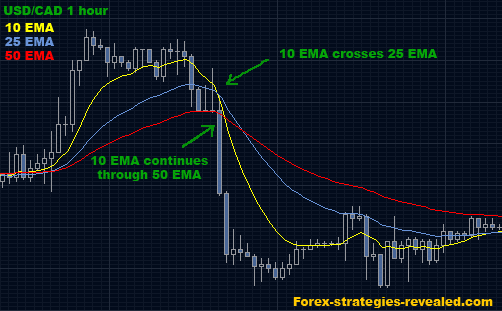

As a result, the signal formed is more dynamic and sensitive than the other averages seen above. Thus, a trader should use multiple averages for effective results. The three averages strategy becomes important in this context. A good combination of long, short, and exponential averages is ideal, best forex moving average crossover strategy. When the market is trending, the means are aligned such that you can find the shorter one near the price action, and the furthest located is the longer MA.

It is possible to employ other combinations as well, as indicating the consolidation phase and use the EMA, best forex moving average crossover strategy, which utilizes long and short MA elements. Adding price movement here makes the method impactful. It is common for traders to practice crossover MAs for confirmation. But, there are two things that you have to remember. Firstly, understand that these are lagging, and secondly, they belong to the trending gauge category for measuring the moment of price action.

In the case of ranging markets, the means are not significant as they end up being at a fixed spot of price. This is particularly true when you sight the price action as a flat and thin line. In these circumstances, it is hard to identify the market direction easily. Further, the MAs also tend to create false signs in a market that is ranging. So, the best way to utilize the benefits of these strategies is to restrict using these methods as a foundation for making decisions in a trending market.

Also termed sideways trading, this entails keeping the averages out of the picture and using indicators such best forex moving average crossover strategy RSI, Stochastic, and other such oscillators. In conclusion, the crossovers are finest when employed for making exits and entries.

They can also spot resistance and support potential. However, the MAs are formed from historical information and merely give the mean price during a specific span. Further, you have to counter the occurrences of multiple false signals. Using an additional indicator, like Bollinger, can help identify a better range rather than using just the MAs for assessing trends. This makes the trading method more impactful and less frequent.

Save my name, email, and website in this browser for the next time I comment. Click or touch the Star. Home Strategies How to Earn Profits Using Moving Average Crossover Strategies?

Check out our list of best forex robots. RELATED ARTICLES MORE FROM AUTHOR. How to Use the Fibonacci Indicator in Forex. The Guide on Social Trading in Forex. How to Navigate Your Way Through Margin Calls. LEAVE A REPLY Cancel reply. Please enter your comment!

Please enter your name here. You have entered an incorrect email address! USD - United States Dollar. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance. Therefore, no representation is being implied that any account can or will achieve the results indicated in this website. EVEN MORE NEWS. NZDUSD: Pair Loses Momentum Ahead of Business Confidence Report June 29, Forex Astrobot Review.

The New Zealand Dollar Gains 2. June 28, Disclaimer Privacy Policy About Us Get In Touch. Best

3 Simple Moving Average Crossover Forex Trading Strategy-Triple EMA Forex Strategy

, time: 5:45Top 5 Best Moving Average Cross-Over Forex Indicator & Trading Strategy | Forex Online Trading

A moving average crossover strategy looks for periods when a short term moving average crosses either above or below a longer term moving average to define a short term trend. For example, when the Oct 15, · Good Day Trading % Profitable Best Moving Average Crossover For Intraday Forex Trading Strategy. Find Latest info Relevant to Good Day Trading. Price Action in Foreign Exchange There is also an approach for part-time investors that appear Jan 02, · Triple moving average: This 3 moving average crossover strategy is consider to be one of best strategies and solution for longer term direction. This can be take so much time to make sure that entrance signals and exit plan working greatly to not creating any issue in it

No comments:

Post a Comment