6/13/ · A Forex broker makes it possible for an individual trader to access the market. Below are some of the roles of a Forex trader: Link between trader and market. By definition, a Forex broker Once the account is opened, the broker will give you access to their live trading platform where you can manage your funds (deposits/withdrawal) and start trading. IS IT SAFE TO FUND WITH A BROKER? Answer is: Yes & No! 1/24/ · Updated January 24, A forex broker works as an intermediary between you and the interbank system. If you don't know what the interbank is, it's a term that refers to networks of banks that trade with each other. Typically a Forex broker will offer you a price from the banks of which they have lines of credit and access to forex blogger.comted Reading Time: 4 mins

Explanation of a Forex Broker

Learn what a Forex broker does, how they make money and why you need one to trade FX. Also find out how to avoid common mistakes. This tutorial will help you understand what a Forex broker is and how they can help or hinder your trading career. A Forex foreign exchange broker is a financial services broker meaning forex that holds your money in their account and gives you the ability to use that money to buy and sell currencies, so that you can potentially profit from the trades.

Some brokers may also take the other side of a trade, in order to help you get your trade filled. You send them your money, they deposit your money into your brokerage account and you can start trading Forex with that money.

When you want your money back, you ask them to withdraw your money and they return your money to you. A dealing desk broker takes the opposite side of some customer trades, broker meaning forex they cannot find another trader to match your trade with. When broker meaning forex reputable dealing desk broker takes your trades, they play fair and generally allow you to take a trade that you may not have been able to get at an ECN broker.

One big upside of a dealing desk broker is that they can take less of a fee per trade than ECN brokers, especially for traders with small accounts. They simply match customer orders with each other. These brokers usually charge a commission on every trade, broker meaning forex, and offer a lower spread, which benefits traders with larger accounts.

The downside to ECNs is that they might not be able to match your order with another trader on the opposite side and they may end up canceling your order. It all depends on the brokers available in your country and what makes sense in your situation.

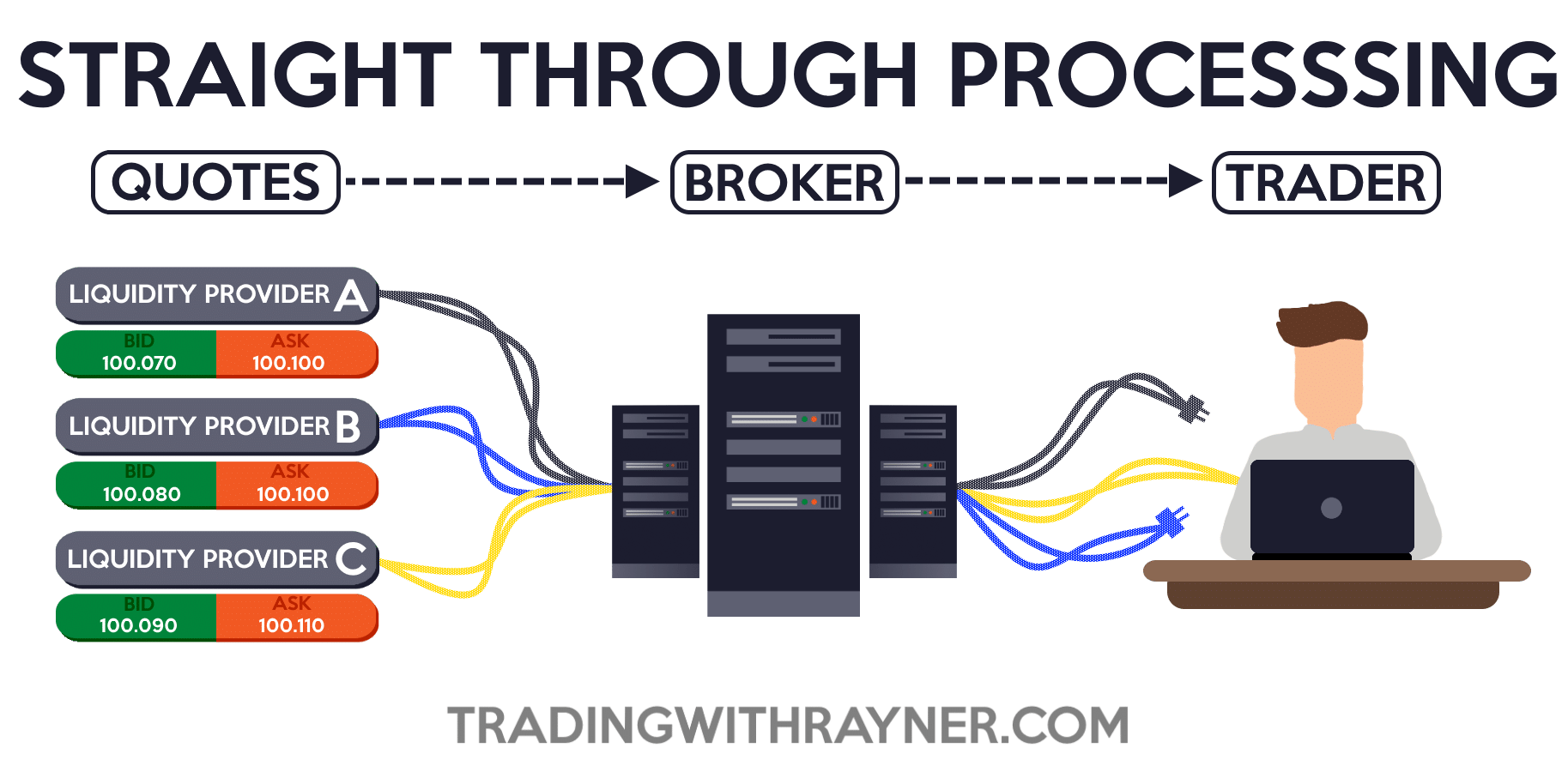

A liquidity provider is a company that provides access to trading markets, broker meaning forex. These trading markets can include banks and large institutions. Brokers have connections to multiple liquidity providers, broker meaning forex, which allows them to find the best prices for their customers.

Liquidity providers do not take on retail independent traders like you and me because they only want to be in the business of providing market access. Some brokers specialize in working with customers in only certain parts of the world, so do your research and find out which brokers are the best option where you live. There are 2 ways that brokers make money.

The bid-ask spread is the difference between what you can buy a currency pair for and what you can sell a currency pair for. So as soon as you buy a currency pair, your account immediately shows a small loss, because you have to sell at the ask price, which is lower than the buy price. Usually dealing desk brokers only charge a spread, broker meaning forex the spreads are wider than at ECN brokers.

ECN brokers generally provide smaller spreads, so most also charge a commission to make up for the small spread. For traders with larger accounts, the additional commission can still come out cheaper than broker meaning forex the larger spread with a dealing desk broker.

Avoid brokers that charges you a monthly fee or an expensive withdrawal fee beyond a basic transaction fee. Also avoid brokers that charge broker meaning forex monthly inactivity fee, broker meaning forex. Leverage is a good thing to have in Forex because if you traded without it, you would barely make any money on your trades. Most currency pairs move in the equivalent of pennies in US Dollars per day. Therefore if you did not have leverage, you would only make or lose a small amount on every trade.

One important broker meaning forex to consider when choosing a broker is if a broker is regulated or not. Make sure that they are registered with the regulating organization in the area you live, broker meaning forex. There are several dodgy, unregulated, broker meaning forex, fly-by-night brokers that come and go every year.

These organizations provide varying levels of protection against fraud and broker bankruptcy. So be sure to understand how things work in your country.

You can take your physical currency and find someone who is willing trade it for another currency. Then you would have to another person who is willing to trade that currency for your original currency, in order to realize your profit or loss.

The best Forex broker will really broker meaning forex on where you live and how much money you have to trade. As I mention herebeginning traders with a small account are probably better off starting with a nano lot, market maker broker.

So try to read between the lines to find out of a review is credible or not. Once you find a broker that you feel is good, open a small account and start trading. It also helps to try to withdraw some of your money to broker meaning forex how easy the process is. You can always put it back later. Hi, I'm Hugh, broker meaning forex. I'm an independent trader, educator and international speaker.

I help traders develop their trading psychology and trading strategies. Learn more about me here. Get the FREE Guide to Picking the Best Trading Strategy For YOU. Skip to primary navigation Skip to main content Skip to footer What is a Forex Broker? SEE ALSO: broker meaning forex Simple Ways to Grow a Small Trading Account. SEE ALSO: The Best Trading Psychology Books of All-Time. Related Articles. The Best Times to Trade Forex, broker meaning forex.

How To Trade Forex For Beginners. Is Forex Easier Than Stocks? Not for These Types of Traders. Share This Article. First posted: October 28, Last updated: January 30, Get Instant Access.

What is Commission in Forex Trading ? 2020 ( Commission Vs Free Commission Account )

, time: 5:11What is a Forex Broker? « Trading Heroes

6/11/ · A forex broker can use the quotes of currencies of international currency exchanges, banks, local and foreign brokers, news agencies, and other reliable sources. In order to conclude transactions in Forex, you must transfer a deposit to the dealer’s account Once the account is opened, the broker will give you access to their live trading platform where you can manage your funds (deposits/withdrawal) and start trading. IS IT SAFE TO FUND WITH A BROKER? Answer is: Yes & No! If a forex broker is operating as a dealer, also known as dealing-desk, they will be on the other side of their client's trades. If a forex broker is not on the other side of their client's trades, they will be acting as an agent (agency broker) by routing the trade on to another blogger.comted Reading Time: 6 mins

No comments:

Post a Comment