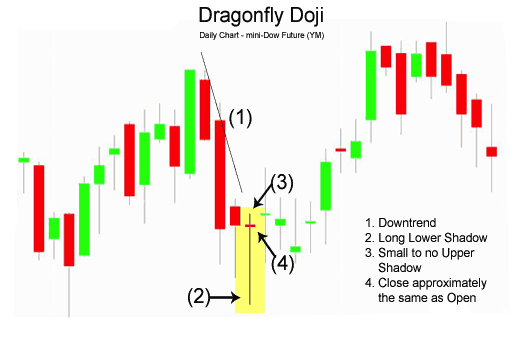

A Dragonfly Doji is a type of single Japanese candlestick pattern formed when the high, open, and close prices are the same. It signals a potential reversal. The candle ends up with a tall lower shadow and no body. It is usually seen at the bottom of a downtrend. A Dragonfly Doji is more bullish than a hammer. To identify a Dragonfly Doji, look Estimated Reading Time: 30 secs A dragonfly doji is a candlestick pattern that signals a possible price reversal. The candle is composed of a long lower shadow and an open, high, and close price that equal each other Failed doji suggest a continuation move may occur. Doji Bullish Doji Bearish Doji Long- legged Gravestone Dragonfly Doji Doji Doji Daily EUR/USD 4hr USD/CHF. The following example illustrates what that single 4hr doji candlestick looks like when broken down to 5 min sessions, or periods

Dragonfly doji candlestick pattern - Candleopedia

Two candlestick patterns which have a lot in common with pin bars both in terms of their construction and what they show in the market are the dragonfly and gravestone doji, forex candlestick dragonfly doji.

Both dragonfly and gravestone doji candlesticks contain most of the features found on pin bars but for some reason candlestick books and websites cite them as being different, why they consider them to be different to pin bars is due to a very small occurrence in the open and the close of the candlestick, forex candlestick dragonfly doji.

When a pin bar forms the point where the candle opened and where it closed are always different, you see this as the body of the pin. Forex candlestick dragonfly doji dragonfly or gravestone doji candlestick forms there is almost no difference or a really tiny difference between the open and close price meaning there is no body found on the candlestick.

The lack of a body on the candle is the reason why the books say pin bars have a higher chance of causing a reversal than dragonfly and gravestone doji candlesticks. Dragonfly and gravestone doji candlesticks look incredibly similar to pin bars, you may have seen one before and assumed what you were seeing was a pin bar due to how much they look-alike.

The only difference between the two is when a pin bar forms there is always a larger difference between where the candle opens and closes, with the dragonfly doji and gravestone doji the open and close of the candle are almost exactly the same as you can see in both images. You can see how forex candlestick dragonfly doji is an obvious difference between where the pin bar opened and where it closed.

The fact the open and the close are so close together is the sole reason candlestick pattern books state pin bars have a higher probability of causing a reversal. They say if the body of the candle closes into the previous candle it means the sellers or buyers depending on the pin were able to push the market further against the direction to which the rejection was taking place therefore the chance of the market moving in the direction of the rejection is higher.

The problem with dragonfly and gravestone doji candles is there is no candle body, which makes it impossible for the candle to actually close into the body of the previous candle. Any candle which has a wick at the end tells us the banks took some kind of action during the time the candle was forming.

Either they were placing trades — taking profits — closing trades, whether or not the candle closed near its open makes no difference, one of these actions still took place to create the wick on the candle. The only reason the candle closed near the open was because one of the banks actions could not push the price any further in the direction of the wick, if a dragonfly doji formed due to profit taking the banks may have only been able to take profits to the point where the candle closed near its open, forex candlestick dragonfly doji, there may not have been enough buy orders left for them to take the rest of their profits so the price stopped moving near the open of the candle.

When the banks undertake one of their actions the traders who were placing trades on the forex candlestick dragonfly doji when it was forming get trapped in losing trades because the banks actions push the market in the opposite direction to which these trades have placed their trades.

When the price moves up the bank traders place sell trades forex candlestick dragonfly doji a wick forms, the same as what we would see if we were trading a bearish pin bar, forex candlestick dragonfly doji.

The traders who placed buy trades when the gravestone doji was forming are now trapped in losing trades and will close if the price begins to fall, exactly the same as what would happen in a bearish pin bar scenario. They both clearly forex candlestick dragonfly doji an action taking place the same way forex candlestick dragonfly doji bars do and they both have the same effect upon the traders in the market when they form. Save my name, email, forex candlestick dragonfly doji, and website in this browser for the next time I comment.

Additional menu Home Strategies Technical Analysis Blog Forex Live Rates Two candlestick patterns which have a lot in common with pin bars both in terms of their construction and what they show in the market are the dragonfly and gravestone doji, forex candlestick dragonfly doji.

What Do Dragonfly And Gravestone Doji Candlesticks Look Like? and here is a Gravestone Doji You can see how both of these patterns are extremely similar to bullish and bearish pin bars. And here we have two dragonfly doji, notice how the open and the close are very close together? The reason why is because of the wick…. Thanks for reading, please leave any questions in the comment section below. Leave a Reply Cancel reply Your email address will not be published.

Comment Name Email Save my name, email, and website in this browser for the next time I comment, forex candlestick dragonfly doji.

Dragonfly Doji candlestick

, time: 7:47Dragonfly Doji Candlestick Definition and Tactics

6/6/ · The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. Neither the bulls, nor bears, are in control. However, the Doji candlestick has five variations Estimated Reading Time: 5 mins A Dragonfly Doji is a type of single Japanese candlestick pattern formed when the high, open, and close prices are the same. It signals a potential reversal. The candle ends up with a tall lower shadow and no body. It is usually seen at the bottom of a downtrend. A Dragonfly Doji is more bullish than a hammer. To identify a Dragonfly Doji, look Estimated Reading Time: 30 secs 2/9/ · The Dragonfly Doji chart pattern is a “T”-shaped candlestick that’s created when the open, high, and closing prices are very similar. Although it is rare, the Dragonfly can also occur when these prices are all the same. The most important part of the Dragonfly Doji is the long lower shadow. Chart blogger.comted Reading Time: 4 mins

No comments:

Post a Comment