Forex Tester v Forex Tester 3 - backtesting software that allows to speed up your learning on Forex by times. Test trading strategies on 15 years of free historical data, dismiss losing methods, discover the systems that can provide you with profits in future Mar 27, · The TradingView application, introduced in , is a decent choice as a cost-free Forex backtesting application. The enhanced charting capabilities are the Mar 28, · Five free back tests a day and a free trial period. Of course there are also plenty of paid backtesting software options out there. You can make backtesting as simple or as complex as you want but all that matters is whether you can follow your system in real time and whether it Estimated Reading Time: 2 mins

Best Forex Backtesting Software for Manual Testing « Trading Heroes

In this article, we would talk about the forex free tools to backtesting forex. A forex tester program is a tool that exposes trade prospects by simulating actual market conditions leveraging historical data. Backtesting techniques operate under the premise that somewhere in the future, trades that have effectively worked in the past would function similarly. The digital tool that helps us verify outcomes electronically and build faith in our methodology nowadays then used free tools to backtesting forex take months and years throughout history.

New technologies have, free tools to backtesting forex, moreover, streamlined the whole thing for all of us. The mechanism has managed to progress ever since, though not necessarily for the better. Many of those who add caution and rational thinking to currency trading approaches for linear regressions are typically in a more substantial spot to be compensated with significant returns. On the other side, significant losses are substantial by traders who add computational resources and leave human reasoning out of the scenario.

No technology can substitute a human brain when analyzing the market and forex strategies, particularly those associated with the correct tool. Download MT4 strategy tester platform. Backtesting that is automated entails creating programs that will dynamically join and leave transactions at your behest. Such programs are eligible for download for free on the web, with paid models purchasable as well, free tools to backtesting forex.

A few of the main benefits of these instruments is that they take emotions out of the investing. To increase their odds of performance, some traders use specific techniques on copy investment strategies. Bear in mind, though, that the software must be tailored to your lifestyle and risk tolerance. Furthermore, not all trade approaches are compatible with automatic trading techniques.

All these MT4 and MT5 are common electronic trade systems for dealing with the capital markets since they are established and stable. The MetaTrader 4 app features Forex Simulation, which helps sellers scroll back time on their graphs and recreate markets from any specific period. Orders may be put, updated, and terminated in the same way they could be in a live system. When you trade on historical information, it saves a great deal of time compared to Demo trading and other modes of Forex trading, free tools to backtesting forex.

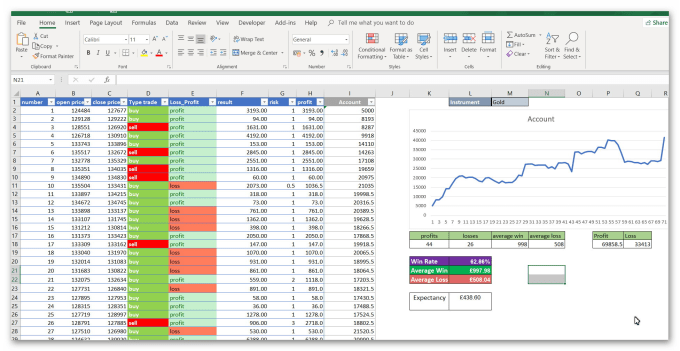

Simulations can be copied to a file and recovered at a later point in time. Per graph has a toggle that helps you to go back in time bar after bar. This is necessary to retrieve everything, from trades, pending orders, free tools to backtesting forex, stop losses, gains, lingering stops, and transaction stats, free tools to backtesting forex. For in-depth research, you could also save the trading account history in excel, free tools to backtesting forex. Apart from the other significant Forex pairs, users could continue to simulate crude oil as the whole forex simulator is among the most effective online and offline channel backtesting of foreign exchange investment strategies.

On Metatrader 4, reports on Expert Advisor EA research findings have lately been substantially enhanced. Investors could now evaluate ratios like the recovery factor, position holding periods, the Sharpe ratio, etc. Cash and equity charts could be used to determine the time duration of financial gains or loss and actions free tools to backtesting forex over days, weeks, or even months. Unlike the Strategy Tester, FX Tester is indeed not cost-free and could be implemented for manual and automatic dealing.

Investors will use this automatic backtesting program to get pre-made techniques. It comes with ten manual programs, five specialist free tools to backtesting forex, a6 years of price history info, a risk assessment system, and even a financial planning table.

MetaTrader 4 has become one of the greatest Currency trading software applications for achieving steady gains, and it also helps you easily backtest Forex techniques. The moving bars may appear on the graph right away. For manipulating the frequency, you should adjust the pace or perhaps even bring new bars. TradingView free chart platform offers a free strategy tester on each featured chart.

Please see the image below:. The TradingView application, introduced inis a decent choice as a cost-free Forex backtesting application. The enhanced charting capabilities are the most well-known feature of this program. The Bar Replay Feature is amongst the most popular backtesting features on this app, free tools to backtesting forex.

Bar Replay: Just use the button on the menu at the top of the page to enable Bar Replay. Change Setups: On the working graph, a fresh toolbar may surface, along with a prominent red line at which the mouse is. The red line denotes the start of that same replay. Tap the Play Button: To enter the replay phase, first tap on the chart; next, press upon this play icon to begin the replay.

Please note that the replay function is a perfect way to see how the charts appeared on a particular day before implementing a plan. The currencies you test, on the other hand, must have sufficient free tools to backtesting forex evidence. Though the TradingView software has several shortcomings that you must note, including the following:. Consumers merely insert information such as account size, optimal entrances, and withdrawals, take-profit thresholds, trailing stops, profit expectations, back-testing hours, profit expectations, slippage cost, etc.

The below are a few of the benefits of the gain Finder, free tools to backtesting forex. There are several corporate online Forex backtesting applications to explore in addition to consumer backtesting sites like TradingView or Meta trader 4. Organizational backtesting program is commonly used for proprietary brokerage firms, mutual funds, and family companies.

Once the customer has free tools to backtesting forex a license for using such applications, is it authorized for use. Despite their high price tag, they have a comprehensive solution kit for information gathering, Foreign exchange strategy testing, historical backtesting, and interactive implementation of high-ranking strategies throughout various techniques.

Since these devices are more event-driven, the framework of backtesting they offer will more accurately replicate live trading conditions. Such instances are as follows:. Utilizing Dot Net or CQuantOffice by Deltix helps in visual creation, back-testing, and monitoring of unified EMS techniques. Numerous intra-day, tick, and custom-designed durations can be used to build patented order execution architectures.

Users may also test, modify, or boost the performance of the selected parameters in a specific technique. Users will compare technique outcomes with the aid of helpful stats. Forex backtesting is a historical fact-based trading technique whereby traders use historical data to analyze whether a strategy will work or not.

A backtesting framework concept is free tools to backtesting forex collection of technological guidelines represented by a set of past market data and a corresponding review of the results which would have been produced by a Forex strategy across a given timeframe. That is a useful notion of forex strategy tester software. For Currency traders, backend checking has a variety of advantages, such as:. Practice: Forecasting could really help traders pinpoint investment options by analyzing past price fluctuations and relative positions.

In other terms, it allows traders to improve their knowledge in research work. Confidence : Currency backtesting is a successful way to create confidence free tools to backtesting forex traders obtain expertise by testing prior market knowledge from dealers. When they actually begin trading in real, it helps develop their morale. Every one of these variables eventually converges to enable traders to gain greater progress in their trade.

Thinking, how to do backtesting in forex in actuality? The below is how it all plays a part with forex backtesting software technology. A collection of market data is added to forex trading techniques, and transactions are replicated using the same information. Traders will use this information to measure any unintended deficiencies in their existing strategies.

Put another way; it is often possible to try innovative techniques before including them in live markets. Investors may receive a wide variety of indications based on the types of backchecking tools being used in Forex trading, such as:. These all indicators give you information regarding the success of your Foreign exchange investment strategies.

These same following three aspects that really can eventually determine trading strategies must be known. In backtesting, the validity and precision of value are critical.

This has to be proportional to the methodology, too. Around the same moment in time, electronic forex traders and bankers have separate pricing details. When that method is implemented quite a few times on a set of data, and how would the approach works? Methods for backtesting ought to be actually completely deterministic. Each moment you backtest a Foreign exchange policy for a structured data set, you must get similar findings. That reasonable and accurate is the business logic integrated into the back tester?

Backtests cannot reflect the actual markets exactly. You might well overlook significant factors such as latency, free tools to backtesting forex, rejections, slippage, or even requotes. Bars information or ticks data also becomes essential to remember. Tick information can enable your data to be almost perfectly historically simulated.

When adding bar info, this method is slower. Through bar info, you get 4 price points for each timeframe. The greater the timeframe, the more precise the outcomes will also be.

Please keep in mind that sometimes the finest software for backtesting could not promise potential earnings. Very few and far between liquidity in the Foreign exchange markets is a recurrent issue. This is regulated by different exogenous variables and is quite hard to model. There are indeed a variety of back-testing tools available on the market today.

Each particular program seems to have its own way of assessing Forex investment strategies. Forex backtesting can be divided into 2 types. The first is manual and then comes automatically. As a trader, you can also have the potential to exchange risk-free for a trial brokerage account. It ensures that dealers can stop placing their money at risk but can select whether they want to switch to live to trade. Many broking companies offer traders access to high quality and real-time market analysis, the opportunity to exchange with digital currencies, including exposure to new trading tips from experts.

EASY WAY TO BACKTEST YOUR STRATEGY FOR FREE

, time: 9:00The Ultimate Beginner's Guide to Forex Backtesting « Trading Heroes

Mar 27, · The TradingView application, introduced in , is a decent choice as a cost-free Forex backtesting application. The enhanced charting capabilities are the Forex Tester v Forex Tester 3 - backtesting software that allows to speed up your learning on Forex by times. Test trading strategies on 15 years of free historical data, dismiss losing methods, discover the systems that can provide you with profits in future Mar 26, · Despite its considerable analytical value, traders can find free Forex backtesting software online, for example, on MetaTrader 4 platforms. Here they can select the currency pair or even a commodity of the choice, module, a timeframe, and indicator or strategy. After choosing those variables, a trader can start conducting the test

No comments:

Post a Comment