33 rows · 4. 8. · The euro foreign exchange reference rates (also known as the ECB reference The rate set by the foreign exchange controlling forces (Central bank for example) is called the normal or true rate. The rate determined by the market forces on the basis of demand and supply is called the actual rate. The actual rate revolves around the normal rate Foreign Exchange Rates The Financial Markets department compiles indicative foreign exchange rates daily for use by the general public. These rates reflect the average buying and selling rates of the major participants in the foreign exchange market at the open of trade every day, thus providing a good indicator for any interested party on the value of the shilling on any particular day

Euro foreign exchange reference rates

The reference rates are usually updated around CET on every working day, except on TARGET closing days. They are based on a regular daily concertation procedure between central banks across Europe, central bank forex exchange rates, which normally takes place at CET.

To import CSV files into your spreadsheet, choose a setting that uses a dot ". We are always working to improve this website for our users. To do this, we use the anonymous data provided by cookies. Learn more about how we use cookies. See what has changed in our privacy policy. Search Options. Sort by ANYTIME PAST MONTH PAST YEAR. Sort by Relevance Date. Currency Spot Chart USD US dollar 1. Downloads Latest reference rates PDF CSV.

zip XML RSS feeds Download a PDF with the exchange rates of a specific day. Related information Framework for the euro foreign exchange reference rates ECB introduces changes to euro foreign exchange reference rates, central bank forex exchange rates, 7 December Time series for bilateral exchange rates.

NOT AN EXPERT? CHECK EXPLAINER. All pages in this section. Are you central bank forex exchange rates with this page? Our website uses cookies We are always working to improve this website for our users. Learn more about how we use cookies I understand and I accept the use of cookies I do not accept the use of cookies.

We have updated our privacy policy We are always working to improve this website for our users. See what has changed in our privacy policy I understand and I accept the use of cookies I do not accept the use of cookies. Your cookie preference has expired We are always working to improve this website for our users.

This feature requires cookies.

IF YOU HOLD XRP YOU NEED TO WATCH THIS VIDEO!! RIPPLE XRP COULD OUTPERFORM BITCOIN AND ETHEREUM

, time: 10:01How Central Banks Impact the Forex Market

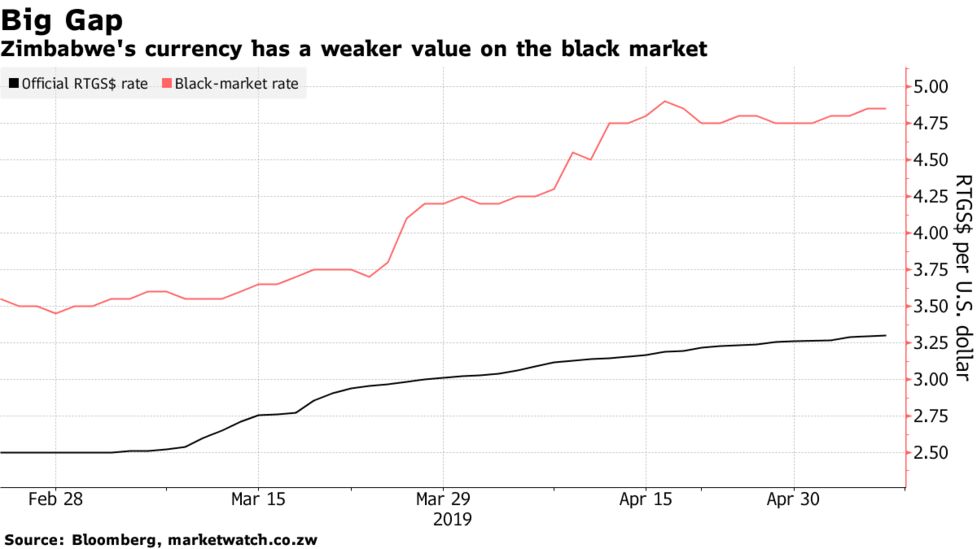

The rate set by the foreign exchange controlling forces (Central bank for example) is called the normal or true rate. The rate determined by the market forces on the basis of demand and supply is called the actual rate. The actual rate revolves around the normal rate 5. · Here we’re going to have a look at the basic mechanics that cause central bank decisions to hit the forex markets. The important thing to remember is that old solid Supply and Demand. Currencies trade based on this in the same way as any other commodity. Central Banks have to affect on, the other or both in order to change exchange rates rows · Forex. The exchange rate released by the Central Bank of Kenya is an indicative rate,

No comments:

Post a Comment