4. · Improve your forex trading by learning the main groups of chart patterns: reversal, continuation and blogger.comted Reading Time: 3 mins Free trading charts for forex, major commodities and indices. Our charts are fully interactive with a full suite of technical indicators 5. · Which forex chart patterns are best to trade? Rectangle, Trend line, Channel, pennant, flag, triangle, rising and falling wedge, head and shoulder are the most used forex chart patterns by professional traders world blogger.comted Reading Time: 8 mins

Most Commonly Used Forex Chart Patterns

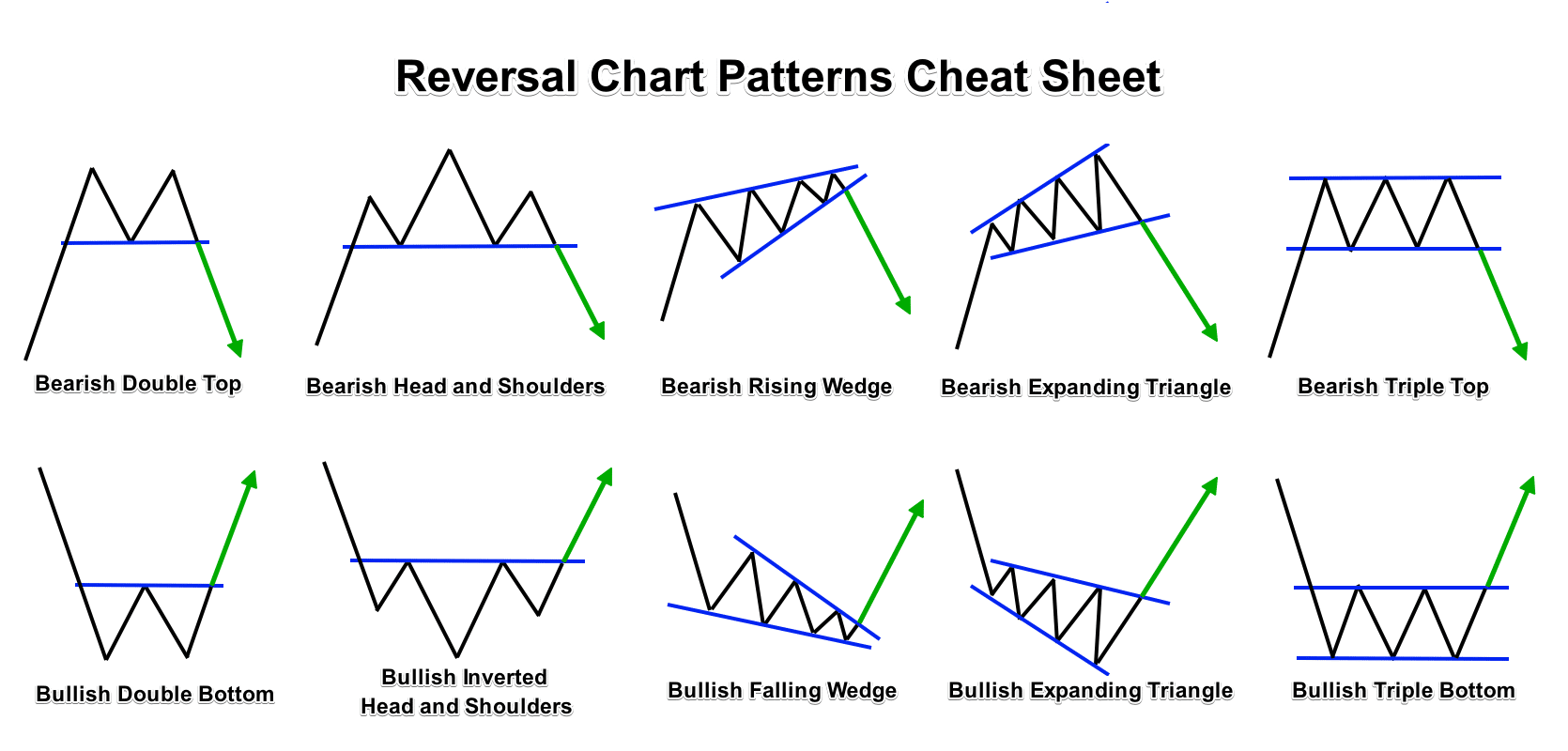

Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. If a reversal chart pattern forms during an uptrendit hints that the trend will reverse and that the price will head down soon. Conversely, if a reversal chart pattern is seen during a downtrendit suggests that the price will move up later on.

In this lesson, we covered six chart patterns that give reversal signals. Can you name all six of them? To trade these chart patterns, simply place an order beyond the neckline and in forex chart patterns direction of the new trend. A reasonable stop loss can be set around the middle of the chart forex chart patterns. For forex chart patterns, you can measure the distance of the double bottoms from the neckline, forex chart patterns, divide that by two, forex chart patterns, and use that as the size of your stop.

Continuation chart patterns are those chart formations that signal that the ongoing trend will resume. Usually, these are also known as consolidation patterns because they show how buyers or sellers take a quick break before moving further in the same direction as the prior trend.

Note that wedges can be considered either reversal or continuation patterns depending on the trend on which they form. To trade these patterns, simply place an order above or below the formation following the direction of the ongoing trend, of course. For example, forex chart patterns, when trading a bearish rectangle, place your stop a few pips above the top or resistance of the rectangle. Bilateral chart patterns are a bit more tricky because these signal that the price can move EITHER way.

This is where triangle formations fall in. Remember when we discussed that the price could break either to the topside or downside with triangles? To play these chart patterns, you should consider both scenarios upside or downside breakout and place one order on top of the formation and another at the bottom of the formation.

If one order gets triggered, you can cancel the other one. The only problem is that you could catch a false break if you set your entry orders too close to the top or bottom of the formation. Opportunity is missed by most people because it is dressed in overalls and looks like work.

Thomas Edison. Partner Center Find a Broker, forex chart patterns. Next Lesson Chart Patterns Cheat Sheet.

Jenis-jenis Reversal Chart Pattern #saham #belajarsaham #duniasaham

, time: 17:55Forex Candlestick Chart Patterns PDF | Forex eBook PDF

Free trading charts for forex, major commodities and indices. Our charts are fully interactive with a full suite of technical indicators Forex chart patterns Chart patterns are classified as a continuation pattern and reversal patterns based on the patterns’ ability to reflect the underlying asset’s directional bias. The completion of continuation patterns indicates the best possibility of the prices to 4. · Improve your forex trading by learning the main groups of chart patterns: reversal, continuation and blogger.comted Reading Time: 3 mins

No comments:

Post a Comment