But when you are dealing with Forex. There is a little bit of terminology that you might want to familiarize yourself with: Standard Lot (, Units) Mini Lot (10, Units) Micro Lot (1, Units) Nano Lot (Below 1, Units) For example In a standard lot, it represents , units of currency So in forex, when you enter a position with 1 standard lot you are “purchasing” $, worth of currency with a $2, margin deposit 5/22/ · While $ per pip seems like a small amount, in forex trading, the market can move pips in a day, sometimes even in an hour. If the market is moving against you, that adds up to a $ loss. It's up to you to decide your ultimate risk tolerance. but to trade a mini account, you should start with at least $2, to be blogger.comted Reading Time: 4 mins

What is Leverage Meaning? - Forex Education

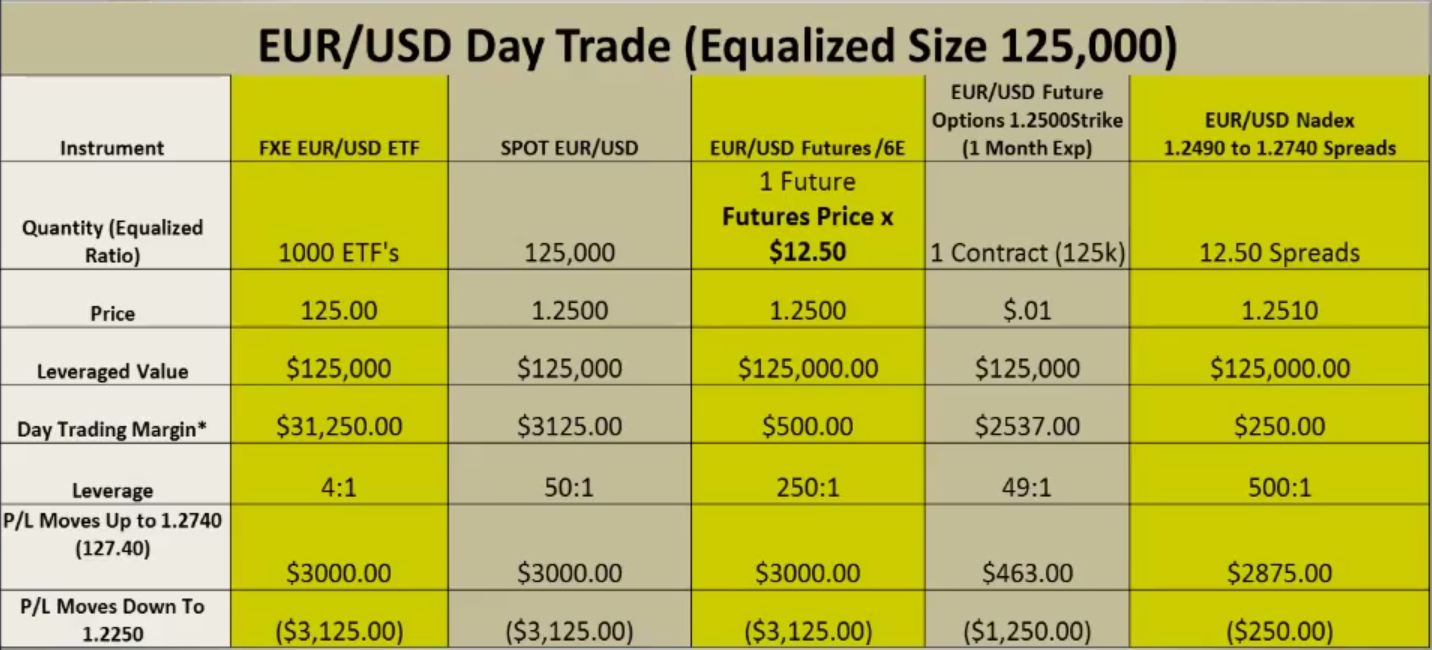

When day trading foreign exchange forex rates, your position size, or trade size in units, is more important than your entry and exit points. You can have the best forex strategy in the world, but if your trade size is too big or small, you'll either take on too much or too little risk.

And risking too much can evaporate a trading account quickly. Your position size is determined by the number of lots and the size and type of lot you buy or sell in a trade:. Here's how all these elements fit together to give you the ideal position size, no matter what the market conditions are, what the trade setup is, or which strategy you're using. This is the most important step for determining forex position size. Set a percentage or dollar amount limit you'll risk on each trade.

If your risk limit is 0. Your dollar limit will always be determined by your account size and the maximum percentage you determine.

1 10000 what does this mean in forex limit becomes your guideline for every trade you make. While other trading variables may change, account risk should be kept constant. Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you.

Pip risk on each trade is determined by the difference between the entry point and the point where you place your stop-loss order. A pip, which is short for "percentage in point" or "price interest point," is generally the smallest part of a currency price that changes.

For most currency pairs, a pip is 0. For pairs that include the Japanese yen JPYa pip is 0. Some brokers choose to show prices with one extra decimal place. That fifth or third, for the yen decimal place is called a pipette.

A stop-loss order 1 10000 what does this mean in forex out a trade if it loses a certain amount of money. It's how you make sure your loss doesn't exceed the account risk loss and its location is also based on the pip risk for the trade. Pip risk varies based on volatility or strategy.

Sometimes a trade may have five pips of risk, and another trade may have 15 pips of risk. When you make a trade, consider both your entry point and your stop-loss location, 1 10000 what does this mean in forex. You want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs.

Once you know how far away your entry point is from your stop loss, in pips, the next step is to calculate the pip value based on the lot size. If you're trading a currency pair in which the U. dollar is the second currency, called the quote currency, and your trading account is funded with dollars, the pip values for different sizes of lots are fixed.

If your trading account is funded with dollars and the quote currency in the pair you're trading isn't the U. dollar, you will have to multiply the pip values by the exchange rate for the dollar vs. the quote currency. The only thing left to calculate now is the position size. The ideal position size can be calculated using the formula:. In the above formula, the position size is the number of lots traded. If you plug those number in the formula, you get:.

Since 10 mini lots is equal to one standard lot, you could buy either 10 minis or one standard. That again is 10 pips of risk. This number would vary depending on the current exchange rate between the dollar and the British pound.

So your position size for this trade should 1 10000 what does this mean in forex eight mini lots and one micro lot. Trading Forex Trading. Full Bio Follow Linkedin.

Follow Twitter. Cory Mitchell, Chartered Market Technician, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Read The Balance's editorial policies. Reviewed by. He currently holds a Series 7, and Series 66 licenses.

Article Reviewed on May 21, Read The Balance's Financial Review Board, 1 10000 what does this mean in forex. Your position size is determined by the number of lots and the size and type of lot you buy or sell in a trade: A micro lot is 1, units of a currency. A mini lot is 10, units. A standard lot isunits. Set Your Account Risk Limit Per Trade. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you.

Understand Pip Value for a Trade If you're trading a currency pair in which the U.

Understanding Forex Leverage, Margin Requirements \u0026 Trade Size

, time: 10:12What does a leverage of mean in Forex? - Quora

7/21/ · MM in Forex almost always involves compounded numbers. What starts off as 10% of can easily increase to 10% of , and so on and so on. Why not break it down even further and have a target of 1% per trading day? This becomes roughly 5% per week, which translates to 5/22/ · While $ per pip seems like a small amount, in forex trading, the market can move pips in a day, sometimes even in an hour. If the market is moving against you, that adds up to a $ loss. It's up to you to decide your ultimate risk tolerance. but to trade a mini account, you should start with at least $2, to be blogger.comted Reading Time: 4 mins 4/13/ · Standard lot forex Standard lot forex size represents trading units or 1 lot size, and it is the standard size in forex trading accounts that professional traders use. In that case, 1 lot size profit is $ for every 10 pips moves in the direction of a trading blogger.comted Reading Time: 1 min

No comments:

Post a Comment