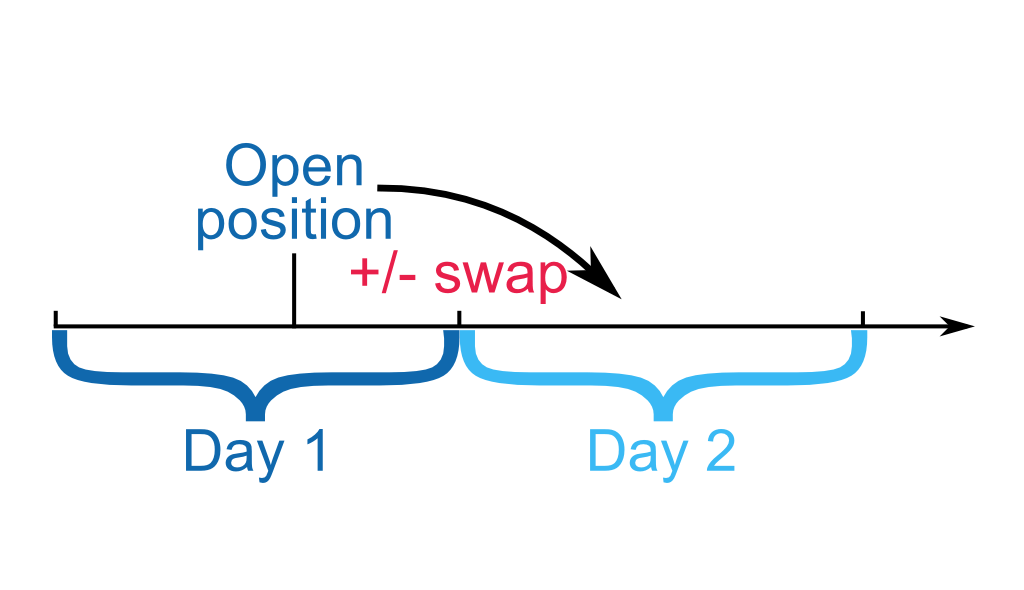

EGM Securities offers "rolling spot" forex. This means we don't arrange physical delivery of currencies/precious metals, hence all positions left open from to (server time) will be rolled over to a new value date. As a result, positions are subject to a swap charge or credit. Please read our rollover/interest policy to find Swap is also called the rollover charge and basically, it’s a fee that your broker charges for holding a position overnight There are at least three ways you can avoid paying swap rates. 1. Trade in Direction of Positive Interest. You can go trade only in the direction of the currency that gives positive swap. This is generally not recommended unless trading in that sp

What is Forex Swap-The hidden cost of Forex - blogger.com Blog

In Forex, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position, depending on the underlying interest rates of the two currencies in the pair. In the examples below, we'll show you how to calculate the amount that will be credited or charged, factoring in only the interest rates and the broker's commission, but in reality, the "storage" for holding a position overnight may depend on a variety of factors:.

Let's say that the interest rate of the European Central Bank ECB is 4. You open a short position Sell on EURUSD for 1 lot. Here, you are essentially sellingEUR, borrowing at a rate of 4. In selling EURUSD, you are buying US Dollars, which earn interest at a rate of 3. When the interest rate of the country whose currency you are buying is more than the interest rate of the country whose currency you are selling, storage will be added to your trading account this may not always hold true, as brokers often charge a fee or markup for overnight swaps.

If the interest rate is higher in the country whose currency you are selling, as is the case in this example 4. Now let's say the broker charges an extra 0. Add this to the 0. For the position described above, the storage you will be charged will be equivalent to being charged 1.

Calculating the swap on a short position: Here we are buying USD and selling EUR, holding too long causes swap in forex. Since the interest rate of the currency we are selling EUR: 4.

When your short position on EURUSD is rolled over to the next day, 3. Calculating the swap on a long position: When we buy EURUSD, we are buying EUR and selling USD. Since the interest rate of the currency we are buying EUR: 4.

When holding too long causes swap in forex long position on EURUSD is rolled over to the next day, holding too long causes swap in forex, 1. Please Note: When the difference between the interest rates is smaller than the broker's commission, you will be charged storage for both Buy and Sell orders.

Calculating the swap for stock index CFDs: In our example, we will calculate the swap for keeping a short position open overnight on the ASX index, holding too long causes swap in forex. As a result, when data from the trading terminal is used to calculate the swap on the SPX instrument, the following formula is holding too long causes swap in forex. Calculating the swap for commodity CFDs: In our example, we will calculate the swap for keeping a short position open overnight on the NG instrument.

You can find our swap points for different trading instruments in our Contract Specifications Swap Short and Swap Long. Swap rates are subject to change. The swap rates in our "Contract Specifications" are updated holding too long causes swap in forex at EET. You can also calculate the swap charges for long and short positions with our "Trader's Calculator". Please note that on the Forex market, when a position is held open overnight from Wednesday to Thursday, storage is tripled.

This is because a swap involves pushing back the value date on the underlying futures contract. For a position opened on Wednesday, the value date is Friday. When a position is kept open overnight from Wednesday to Thursday, the value date will be moved forward 3 days, to Monday skipping over the weekend. Storage is tripled because you are being paid or charged interest for 3 days instead of just one. Triple storage is also charged for keeping positions on commodity CFDs open from Friday to Monday.

A new exciting website with services that better suit your location has recently launched! Home page FAQ Trading conditions.

What happens when I leave my Forex positions open overnight? In the examples below, we'll show you how to calculate the amount that will be credited or charged, factoring in only the interest rates and the broker's commission, but in reality, the "storage" for holding a position overnight may depend on a variety of factors: The current interest rates in the two countries The price movement of the currency pair The behavior of the forward market The swap points of the broker's counterparty Here's what we mean when we say storage depends holding too long causes swap in forex interest rates: Let's say that the interest rate of the European Central Bank ECB is 4.

Lots refer to the volume of an open order. Contract is the size of 1 lot. The swap rate for metals can be calculated in the same way as for currency pairs.

Popular questions Forex trading hours. When will my demo accounts expire? Why wasn't my order triggered? The Low was 2 pips below the order level. Can I lower my leverage? How can I calculate my profits or losses on a position? Why did my broker close my position without my consent? How do I calculate the margin required on hedged positions? How do you calculate margin with floating leverage based on the total notional value of open positions? How is commission on pro.

mt4 and ecn. mt5 accounts calculated? What are the risks of trading during periods of low liquidity? How do I calculate the minimum amount required to open a position margin? How are dividend adjustments calculated for index CFDs?

How do you calculate the value of 1 pip? Does Alpari put client positions on the market?

What is SWAP in Forex Trading? - FXOpen Explains How to Calculate It

, time: 1:42How Long Should You Hold a Forex Trade? « Trading Heroes

EGM Securities offers "rolling spot" forex. This means we don't arrange physical delivery of currencies/precious metals, hence all positions left open from to (server time) will be rolled over to a new value date. As a result, positions are subject to a swap charge or credit. Please read our rollover/interest policy to find Jun 04, · Swap rate, also referred to as Rollover rate, is the overnight interest (that is charged or paid) for holding positions open overnight in foreign exchange trading. It is determined by the overnight interest rate differential between the two currencies involved in the pair and whether the position is a buy ‘long’ or sell ‘short’.Estimated Reading Time: 2 mins Mar 17, · The length of time that you hold a Forex trade open will primarily be determined by your trading strategy, current psychology and status of the trade. While it is possible to keep a trade open anywhere from a few seconds, to a few years, most traders keep their positions open for a time period that is somewhere in between

No comments:

Post a Comment