rows · Why low spreads matter in Forex? The benefits of trading with a lower bid/ask spread Eventually, the Forex trading proposal is so wide now that Brokers doing their best to lower its own costs and propose attractive conditions to suit trading demand. As an example, Low spread is crucial to perform scalping or hedging strategy, as it’s lowering the cost since the methods perform a lot of open and close positions during the session Always be careful by trading forex. The pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is

Best Low Spread Forex Brokers | ForexBrokers

Fancy finding out more about what the spread is and how it works? Be sure to read our comprehensive guide on What is Spread in Forex? Note: Although some forex brokers offer super-tight spreads on their major pairs, you still need to assess what the commission amounts to. This ensures that the forex lowest forex spreads in question always makes a profit — regardless of which way the markets go. The spread is an important talking point in the world of forex, not least because it will dictate how much you are paying to trade.

In other words, the higher the spread, lowest forex spreads, the more you are indirectly paying in fees. As soon as the order is placed, you would be in the red by 0. Well, lowest forex spreads, because if you wanted to sell your position, you would need to do so at 1.

As this is less than what you paid, the spread puts you at an immediate disadvantage as soon as you lowest forex spreads an order. The reason for this is that in order to ascertain the width of the spread, we need to be able to quantify pricing movements in pips.

First and foremost, when we trade forex online, we normally do so to profit off of ultra-small pricing movements. As such, most forex pairs will contain four digits after the decimal point. So now that you lowest forex spreads what the spread is, as well as how pips are calculated, lowest forex spreads, we can now show you a real-world example of the spread. As such, you believe that EUR will outperform USD, meaning that the exchange rate will lowest forex spreads up, lowest forex spreads.

As you can see from the above example, even though the buy price is 1. Before it reaches this price, you would need to exit your trade at a lower price than what you paid. In a similar nature to pips, pipettes relate to the ultra-small pricing movements of a forex pair. As such, the movement of 1 pipette would amount to 0. As such, the spread would, lowest forex spreads, therefore, lowest forex spreads to 0.

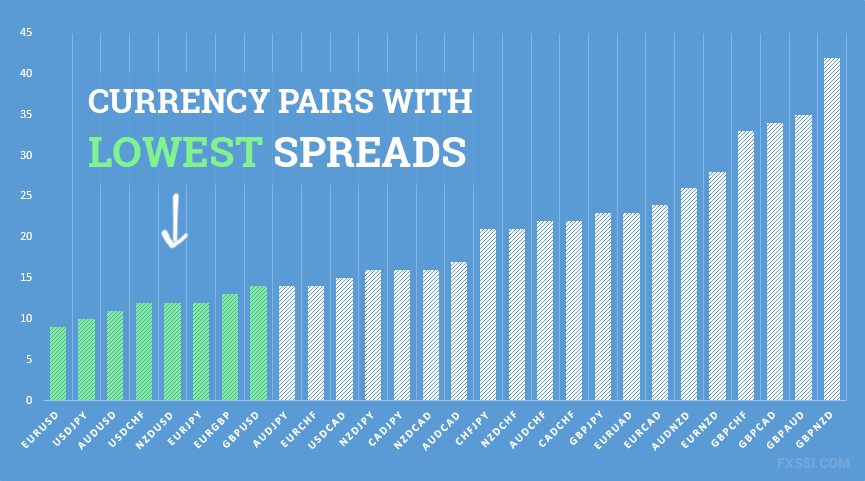

Nevertheless, we are now going to explore what sort of spreads you should be aiming for when using a forex broker. Firstly, the width of the spread will be determined by the underlying trading pair.

The reason for this is liquidity. And what happens when markets lowest forex spreads from low liquidity levels? Volatility is high, lowest forex spreads. As such, the forex spreads of exotic pairs will always be significantly higher than that of the majors. In some cases, a number of brokers will offer a spread of zero on its major pairs. However, this is typically reserved for those with a professional trading account. Moreover, the zero forex spreads forex broker will likely offer this during standing trading hours only, lowest forex spreads.

On the contrary, you need to look at a range of other variables. This includes regulation, lowest forex spreads, the number of instruments that you can trade, and the type of lowest forex spreads methods it supports. Although the broker might truthfully offer some of the lowest spreads in the market, it might make up for this in other areas — such as commission, deposit fees, or overnight financing.

Most forex brokers will charge a trading commission of some sort. This is usually a small percentage of the amount that you trade. For example, if the broker charges a commission of 0. You usually need to pay a commission at both ends of the order. As such, check whether or not your preferred payment method comes with a transaction fee.

As such, although you might be paying a super-tight spread at the broker, you might be paying for this when you apply leverage. So now that you have a firm grasp of what the spread is, and how it will have a direct impact on your ability to make gains in the long run, we are now going to list our top 3 forex broker picks. These brokers offer some of the lowest spreads in the UK trading space. With that being said, just make sure that you perform additional research on the broker before signing up.

com is an FCA-regulated online broker that offers heaps of financial instruments. All in the form of CFDs - this covers stocks, indices, commodities, and even cryptocurrencies. You will not pay a single penny in commission, and spreads are super-tight. Leverage facilities are also on offer - fully in-line with ESMA limits. Once again, this stands at on majors and on minors and exotics. If you are based outside of Europe or you are deemed to be a professional client, you will get even higher limits.

Getting money into Capital. Visit Capital. com In summary, if you've read our guide all of the way through, you should have a good understanding of what the spread is, how you calculate it, and why it's crucial to stick with brokers that offer 'tight' spreads. With that being said, you should never choose a new forex broker primarily on the size of the spread. On the contrary, the broker might be charging you in other areas of the platform, lowest forex spreads.

As such, always perform enhanced research on a broker before signing up. Author: Samantha Forlow. Samantha is a UK-based researcher and writer that specializes in all-things finance. This covers everything from traditional equity and fund investments, to forex and CFD trading. Samantha has been writing financial-based content for several years and has a variety of publications in the online domain, lowest forex spreads.

Crucially, she is able to explain complex financial subjects in a newbie-friendly manner. What is Spread in Forex? How to Find Low Forex Spreads Guide Table of Content. Our Lowest forex spreads. Visit Capital Now, lowest forex spreads.

Start your journey towards reaching all your financial goals right here. Visit AVATrade. com — Zero Commissions and Lowest forex spreads Spreads. Zero commissions on all assets Super-tight spreads FCA regulated. Does not offer traditional share dealing.

Author : Samantha Forlow. Article Info Author: Samantha Forlow Last Updated: June 11th, FOLLOW ON.

Low spread Broker - fixed spread in octafx - spread in forex - low your spread in octafx

, time: 6:06��Forex Spreads What Are They? June Guide to LOW Spread Brokers

Always be careful by trading forex. The pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is Eventually, the Forex trading proposal is so wide now that Brokers doing their best to lower its own costs and propose attractive conditions to suit trading demand. As an example, Low spread is crucial to perform scalping or hedging strategy, as it’s lowering the cost since the methods perform a lot of open and close positions during the session rows · Why low spreads matter in Forex? The benefits of trading with a lower bid/ask spread

No comments:

Post a Comment