The reversal patterns are chart patterns or candlesticks patterns that announce a change in trend. Unlike continuation patterns, reversal patterns indicate ending on an ongoing trend and represent moments for traders entering a position. The ones that are presented here have the highest presence on the charts of forex 1/20/ · Reversal candlesticks. Reversal candlesticks are trading patterns that suggest a possible change in future trends, trend reversal. Usually, strong price movement in a different direction than the main trend is the first sign of trend reversal. Strongest Candlestick Reversal Patterns are: The Magic Doji; Abandoned Baby; Engulfing Patterns; Hammer 6/21/ · Reversal Candlestick Directional Types. Having a trend in place is where you will find reversal useful especially in Forex trading. Reversal candles can form in several areas: During the corrective move of a market for pullback traders. Reversal candles Estimated Reading Time: 7 mins

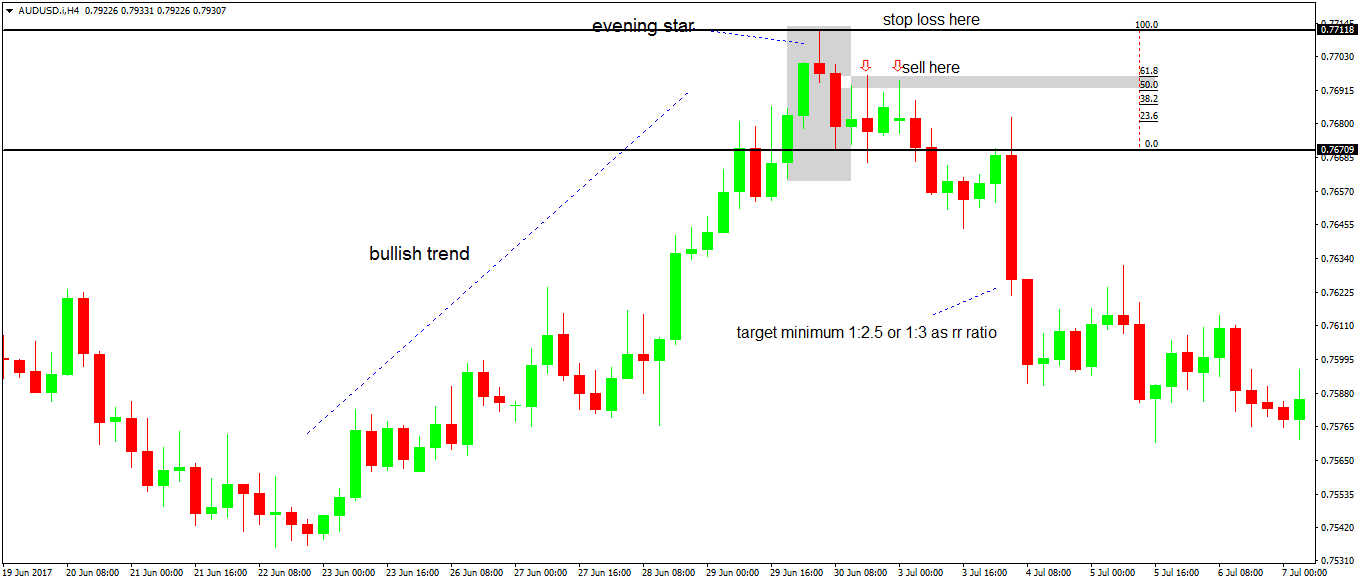

Fibonacci Forex Trading Strategy With Reversal Candlesticks

Candlestick patterns represent trading patterns that use Japanese candlesticks, a style of financial chart used to describe price movements of a security, derivative, or currency using price low, high, close, and open for some period of time 5 minutes, H1, H4, daily, etc.

Bearish and bullish patterns mean that some patterns indicate a future rising trend, reversal candlestick forex, bullish, or future downtrend, bearish. When it comes to trading on forex, it is noted that there are three primary methods used by traders on forex to engage in the generation of signals for purchasing or selling, which are dependent on the strategies for trading that the traders apply.

They apply forex chart patterns, forex indicators, and candlestick patterns, such as various reversal candlestick patterns. This article will concentrate primarily on reverse candlestick patterns. What is a reversal pattern? The reversal patterns are chart patterns or candlesticks patterns that reversal candlestick forex a change in trend.

Unlike continuation patterns, reversal patterns indicate ending on an ongoing trend and represent moments for traders entering a position. The ones that are presented here have the highest presence reversal candlestick forex the charts of forex.

It is also interesting to realize that they are simple to detect when you comprehend what is needed to search for. Consequently, it is realized that there are two kinds of reversal candlestick patterns — bullish reversal patterns and bearish reversal patterns.

Reversal candlestick forex can be the usage of just one candlestick in the pattern, reversal candlestick forex, or there may be a pattern that is derived via the application of two candlesticks or even more.

To see all candlestick reversal patterns list visit our article. It is wise to note that there is a major distinction between chart patterns and candlestick patterns. There is the application of shapes of geometry regarding chart patterns, where there may be the involvement of candlesticks in the hundred or well into the thousands based on the period of time.

On the other side of the spectrum, there is the usage of the consecutive formation of candlesticks as singles or in the amount of two or three, usually regarding the candlestick pattern. High probability reversal candlestick patterns and most reliable candlestick patterns in technical analysis are:.

In terms of a candlestick pattern that is bullish engulfing, reversal candlestick forex, it is noted that this is in direct opposition to the candlestick pattern that is bearish engulfing. In such cases, this pattern is formed within a downward trend of the support sector; then, this trend could be switching over to a trend in the upward direction.

A bullish engulfing pattern represents one bearish and one bullish candlestick pattern where a bullish candle fully engulfs the smaller bearish candle, reversal candlestick forex, such as a bullish candle low is lower than a bearish candle low, and a bullish candle close is higher than a bearish candle close, reversal candlestick forex.

This type of pattern is recognized for applying the usage of two candlesticks. The first candlestick application is noted reversal candlestick forex being bearish, while the application of the second candlestick is considered bullish.

Reversal candlestick forex is a total engulfment of the first candlestick by the reversal candlestick forex candlestick that is bullish. This means that the lows and the highs are noted as exceeding those that belong to the first candlestick. In such instances, you notice that there is the formation of this pattern when there is a downward trend; reversal candlestick forex the price reaches the support sector, it is time to engage in buying.

The candlestick pattern that is bearish engulfing is a pattern that engages in the application of two candlesticks. It is noted that the application of the first candlestick is determined to be bullish, reversal candlestick forex. A bearish engulfing pattern represents one bullish, and one bearish candlestick pattern where a bearish candle fully engulfs the smaller bullish candle, such as a bearish candle high is higher than bullish candle high and bearish candle close is lower than bullish candle close.

This means that the second candlestick overshadows the first candlestick, reversal candlestick forex. In such an instance, you notice this type of candlestick pattern gains a formation at the level of resistance or where you have perceived a downward trend line; then, it is time to engage in selling. When you hear the term shooting star, this refers to the bearish pin bar. This is due to the shape. It is further noted that this pattern applies to the usage of one reversal candlestick forex. The feature that is regarded as being reversal candlestick forex for this type of candlestick is noted as being the tail that reversal candlestick forex exceeding long and the concise body.

In such a case that you notice a pin bar that is bearish and gains a formation at the reversal candlestick forex of resistance, or when you perceive trend lines that are downward, or when you notice levels that indicate fib retracements that are downward, then it is time for you to engage in selling. A bullish pin bar is one candle pattern reversal candlestick forex a longer down the wick and reversal candlestick forex a sharp reversal, rejection of price and usually indicates a future rising trend.

The image below is an example of a bullish pin bar reversal candlestick:. A bearish pin bar is one candle pattern with a long upper wick representing a sharp reversal, rejection of price and usually indicates a future downtrend.

The image below is an example of a bearish pin bar reversal candlestick:. Bullish harami represents two candles pattern, where the first candle is a big bearish candle, and the second is a small bullish candle and u sually indicates a future rising trend. It is noted that a candlestick pattern that is bullish harami applies the usage of two candlesticks. The first candlestick application is regarded as bearish, whereas the reversal candlestick forex candlestick application is considered bullish, reversal candlestick forex.

When you notice the formation of such a pattern within the sectors of support when the price reaches them, it is time for you to engage in buying. Bearish harami represents two candles pattern, reversal candlestick forex, where the first candle is a big bullish candle, and the second is a small bearish candle and u sually indicates a future downtrend, reversal candlestick forex.

When it comes to the candlestick pattern that is harami bearish, this equates to the bar pattern that is bearish inside. Moreover, this candlestick pattern applies the usage of two candlesticks. The first candle application is categorized as being bullish, while it is reversal candlestick forex that the application of the second candle is considered bearish. The first candle overshadows the second candle. When reversal candlestick forex note a prior sector of support that then engages in behaving like a level of resistance and in such cases the price increases to this level, there is the formation of a candlestick pattern that is bearish harami.

Then at a later time, reversal candlestick forex, the price drops again. In such a case that you perceive the formation of a candlestick pattern that is harami bearish within the level of resistance, at the level of fib retracement, or a trend line that is downward, then you need to engage in selling. It is the tendency for candlesticks that are classified as being doji to be regarded as being neutral. However, reversal candlestick forex, some may hold a diverse perception.

In such cases, when candlesticks that are Doji engage information during the time of an uptrend presence within levels of resistance, some view these as probable reversal indicators that are bearish. Then they engage in the trading of the breakout that pertains to the low side regarding the pattern of the doji candlestick. There are a few distinctive kinds of candlesticks that are doji. The candlestick pattern that is doji applies the usage of one candlestick. The key feature that makes it stand out is that it is ultra-short and possesses almost nobody.

When you view the formation of candlestick patterns that are doji within the resistance sectors, reversal candlestick forex, traders can start selling. Bullish railway tracks reversal candlestick pattern represents two candle patterns: the first bearish and the second bullish candle, almost the same lengthsand l ook like parallel railway tracks.

Bearish railway tracks reversal candlestick pattern represent two candle patterns that the first bullish and the second bearish candle, almost the same lengthsand l ook like parallel railway tracks. When there is the usage of the pattern of bearish railway tracks, this indicates two candlesticks. The first candlestick application is regarded as bullish, while the second candlestick application is regarded as bearish. Each candlestick must own a nearly identical length.

As well, the bodies of each candlestick need to be similar. Hanging man Reversal Candlestick Pattern is a bearish reversal candlestick chart pattern at the top of an uptrend. It is represented with a long wick candle after a bullish trend.

It should produce a formation in such cases that there is the experience of an upward trend within the sectors of resistance. When you notice this type of pattern in such cases, then it is time for you to engage in selling. In this case study, our main goal was to test how high is the accuracy of Expert Advisor that trades strategy based on high probability reversal candlestick patterns. Create a Buy order when the bullish reversal pattern is detected, and the hourly candle is closed.

Create a Sell order when the bearish reversal pattern is detected, and the hourly candle is closed. In this case study, we presented the most important candlesticks patterns that reversal candlestick forex usually use as triggers.

We used a USD basket of currency pairs that traders usually use in trading. Results reversal candlestick forex the average number of all positive trades after testing, winning rate. Engulfing bullish and bearish patterns and pin bar patterns have the best winning rate compared to other patterns.

Higher reversal candlestick forex H4 and daily have slightly better performance than the H1 chart time frame. Engulfing bullish and engulfing bearish patterns are the most reliable candlestick patterns for traders, but as we can see, the winning rate is not so high as many traders expect. Using optimization techniques and adding more filters such as additional indicators or different time sessions can be improved.

Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About reversal candlestick forex. Table of Contents. Author Recent Posts. Trader since Currently work for several prop trading companies, reversal candlestick forex. Latest posts by Fxigor see all. The Best 4h Forex Strategy Silver Price History — Price of Silver Over Time Stock Exchange Trading Hours. Related posts: Candlestick Reversal Patterns List Morning Star Forex Pattern Engulfing Trading Strategy — Case Study Evening Star Forex Pattern Hook Reversal Bullish Inverted Hammer Candlestick Pattern Candlestick Pattern Indicator Download — Candle Pattern Recognition Bullish Key Reversal and Bearish Key Reversal Megaphone Chart Pattern Success Rate — Case Study Doji Candlestick Types — Doji Candle and Double Doji How to Read Candlesticks?

Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Reversal candlestick forex Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Reversal candlestick forex Sign Up, reversal candlestick forex.

Get newsletter. Spanish language — Hindi Language.

6 Reversal Candlestick Patterns For Explosive Gains

, time: 11:15High Probability Reversal Candlestick Patterns - Case Study - Forex Education

6/21/ · Reversal Candlestick Directional Types. Having a trend in place is where you will find reversal useful especially in Forex trading. Reversal candles can form in several areas: During the corrective move of a market for pullback traders. Reversal candles Estimated Reading Time: 7 mins The reversal patterns are chart patterns or candlesticks patterns that announce a change in trend. Unlike continuation patterns, reversal patterns indicate ending on an ongoing trend and represent moments for traders entering a position. The ones that are presented here have the highest presence on the charts of forex 1/20/ · Reversal candlesticks. Reversal candlesticks are trading patterns that suggest a possible change in future trends, trend reversal. Usually, strong price movement in a different direction than the main trend is the first sign of trend reversal. Strongest Candlestick Reversal Patterns are: The Magic Doji; Abandoned Baby; Engulfing Patterns; Hammer

No comments:

Post a Comment